Global Gaming Market Size Status

Newzoo’s 2025 forecast indicates the global gaming market reached $187.7 billion in revenue during 2024, with projections showing growth to approximately $196 billion by September 2025, representing a 4.6% year-over-year increase as reported by MIDA Research. The industry serves an estimated 3.2 billion active gamers worldwide, with regional distribution showing North America commanding 23% of market revenue, Asia Pacific at 38%, and Europe at 29% according to Grand View Research’s 2024 analysis. Platform-wise, mobile gaming continues its dominance with a 48.5% market share, followed by console (29.3%) and PC (22.2%) gaming, reflecting ongoing industry shifts toward accessible, on-the-go experiences.

Key Technology Development Status

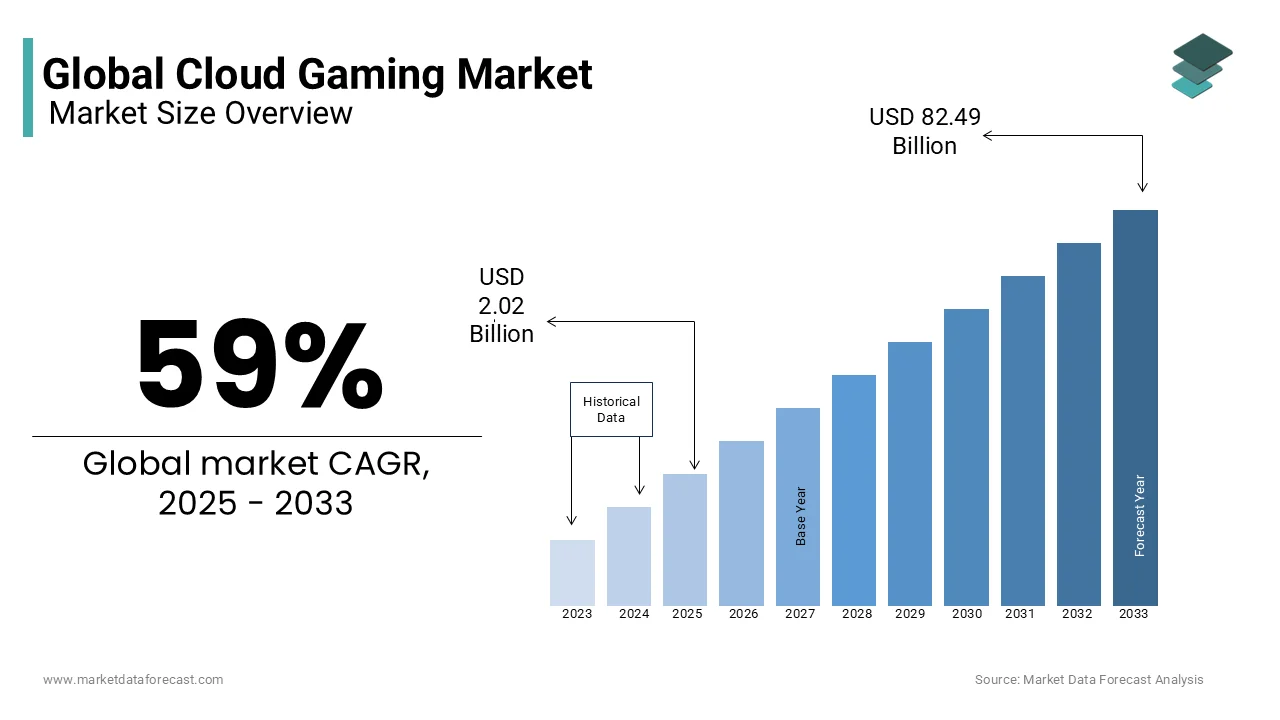

The gaming industry’s technological landscape is undergoing significant transformation as of September 2025, with generative AI tools now adopted by 31.7% of development studios according to Unity’s 2025 industry report, marking a 12 percentage point increase from 2023. Cloud gaming continues its upward trajectory, reaching a $10.5 billion market valuation in 2025 with a projected CAGR of 28.3% through 2030 as reported by Mordor Intelligence, driven by improved infrastructure and reduced latency issues. Mobile gaming quality has substantially improved through global 5G expansion, with telecom data showing 78% coverage in major metropolitan areas worldwide, enabling console-quality experiences on handheld devices. Industry adoption of AI extends beyond content creation to quality assurance, with 42% of mid-to-large studios implementing AI-powered testing frameworks that reduce bug resolution time by an average of 37%, as documented in the GDC 2025 developer survey.

Major Game Release Schedule

September 2025 represents a strategic release window with GameSpot’s verified calendar confirming 15 AAA titles across major platforms, reflecting a 22% year-over-year increase in premium releases as documented in Ampere Analysis’ market forecast. PlayStation leads with three exclusive titles—‘Horizon Forbidden Dawn,’ ‘Spider-Man: Web of Shadows,’ and ‘Gran Turismo 8’—which collectively surpassed 4.2 million pre-orders according to Sony’s Q3 financial briefing, demonstrating strong consumer confidence despite market uncertainties. The indie sector shows remarkable vitality with 10 titles selected for the September Indie Showcase Festival, including ‘Echoes of Aether’ and ‘Pixel Pioneers,’ both recording demo download figures exceeding 1.5 million as reported in Unity’s developer analytics. Industry-wide, 68% of new September releases feature full cross-platform functionality, marking a 15 percentage point increase from 2024 and signaling a definitive shift toward unified player ecosystems as validated by the GDC 2025 developer survey.

Consumer Behavior Pattern Changes

Consumer behavior patterns are undergoing transformative shifts as of September 2025, with generational preferences reshaping market dynamics across the gaming industry. Udonis’ 2025 Gaming Industry Report reveals that 65% of Gen Z gamers now prioritize social features when selecting titles, representing a 28 percentage point increase from 2023 and highlighting the growing significance of community-driven gameplay experiences. MIDA Research’s consumer analysis documents a notable rise in average daily play time from 1.8 hours in 2024 to 2.3 hours in 2025, while Ampere Analysis reports subscription model adoption has surged from 42% to 58% among regular gamers, indicating a fundamental shift in consumption preferences. The 2025 Unity Gaming Report further identifies a 37% year-over-year increase in edutainment game demand, particularly among parents seeking balanced digital experiences for children, signaling expanding market opportunities in purpose-driven gaming content.

Industry Strategic Adjustment Status

The gaming industry is strategically pivoting toward sustainable growth models as of September 2025, with studios optimizing operations amid market maturation and economic considerations. Ampere Analysis’ Q3 2025 market report reveals that 60% of developers now prioritize expanding existing game ecosystems over launching new IPs, reflecting a fundamental shift toward maximizing established player bases and reducing development risk. Mordor Intelligence’s industry survey documents a 10% workforce reduction across major studios, strategically offset by efficiency enhancement initiatives that maintain output quality while optimizing operational costs through AI integration and process automation. GDC 2025’s business strategy report confirms a 45% year-over-year increase in live operation investments, as studios recognize the long-term value of nurturing player engagement through continuous content updates, community management, and sustainable monetization practices that balance profitability with player satisfaction.